Warrant of Arrest In Rem

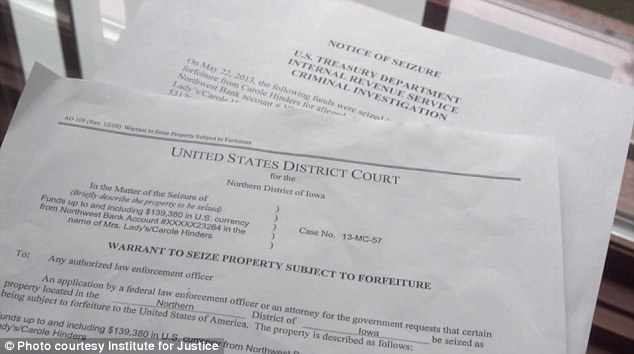

What is a motion for issuance of a warrant of arrest in rem? After filing a complaint in a cash seizure and forfeiture case, when the Government is already in possession of cash, the Assistant United States Attorney (AUSA) will request an order directing the Clerk of the District Court to issue a Warrant of Arrest in Rem for the U.S. Currency named as the Defendant Funds.

In support of its motion for issuance of a warrant of arrest in rem, the United States will show that the U.S. Currency named as the Defendant Funds was seized by federal agents. Many of these seizures of U.S. Currency occur at an airport, a bus or train station, or on the highways. The federal agents that seize U.S. Currency might involve agents with: Homeland Security Investigations (HSI); Customs and Border Protection (CBP); Drug Enforcement Administration (DEA) and Federal Bureau of Investigations (FBI).

The federal agents will claim that the seizure was based on probable cause to believe that the Defendant Funds constitute: money furnished or intended to be furnished by a person in exchange for a controlled substance in violation of the Controlled Substances Act; proceeds traceable to such an exchange; or money used or intended to be used to facilitate a violation of the Controlled Substances Act.

In addition to the drug trade, the seizure for forfeiture can be based on other types of criminal activity such as money laundering. As a result of the seizure, the Defendant Funds are being held by the United States. But after the United States files a Verified Complaint for Forfeiture in Rem, the court might find that it establishes the legal and factual basis supporting the forfeiture of the Defendant Funds.

As required by Rule G(2)(f), the Assistant United States Attorney will allege that the facts set forth in the Verified Complaint support a reasonable belief that the government will be able to meet its burden of proof at trial. That proof specifically requires that the United States will be able to show by a preponderance of the evidence that the Defendant Funds constitute property subject to forfeiture.

Legal Authority for a Warrant of Arrest in Rem – Rule G(3)(b)(I)

The AUSA will likely point to Rule G(3)(b)(i) which provides that the Clerk of Court must issue a warrant of arrest in rem for defendant funds if such property is in the government’s possession, custody, or control. In contrast, the Local Admiralty Rule in many district courts which preceded the enactment of Rule G required that “pre-seizure” (emphasis added), “a judicial officer [must] first review the verified complaint, and any other relevant case papers, prior to the Clerk issuing the warrant of arrest and/or summons in rem.”

Rule G, however, recognizes that if the property is in the government’s possession, there has already been some determination of probable cause or agreement of the parties and the further precautionary step of preliminary judicial review is unnecessary. Since Rule G(3)(b)(i) explicitly provides that a judicial finding of probable cause need not be made before the Clerk issues a warrant of arrest in rem for property already in the custody of the United States when the Defendant Funds are in the United States custody, the United States will request that the court enter an order directing the Clerk to issue the Warrant of Arrest in Rem for the Defendant Funds.

The court will then enter an Order on Motion for Issuance of Warrant In Rem directing the clerk to issue the warrant for the arrest of the U.S. Currency in rem. The U.S. Marshal will then file Form USM-285, a five-copy form set designed as a control document for a process served by a U.S. Marshal or designee.

Legal Authority for a Warrant of Arrest in Rem – Rule G(3)(b)(I)

LA TIMES (9-23-2022): FBI misled judge on Beverly Hills safe deposit box seizure

AUSA CD California Asset Forfeiture and Recovery Section

U.S. Attorney Announces $3.36 Billion Cryptocurrency Seizure and Conviction

Finding an Attorney to Contest the Civil Asset Forfeiture

If you receive notice that an Assistant United States Attorney (AUSA) filed a complaint for forfeiture and caused a warrant of arrest in rem to be issued to Homeland Security Investigations or any other authorized federal law enforcement officer, then contact an experienced civil asset forfeiture attorney at the Rucci Law Firm. We can help you file an answer to the Verified Complaint for Forfeiture in Rem against your seized U.S. Currency or other property.

After you receive notice that the complaint for forfeiture was filed in the U.S. District Court, you only have 35 days from the time the notice was sent to file a Verified Claim in accordance with Rule G(5), of the Supplemental Rules for Certain Admiralty and Maritime Claims. You only have twenty (20) days thereafter to file an Answer or other responsive pleading to the Complaint.

The Claim and Answer or other responsive pleadings must be filed with the Clerk of the Court in the appropriate United States District Court. The Claim must: identify the specific property claimed; identify the claimant; state the claimant’s interest in the property; and be signed by the claimant under penalty of perjury.

If you fail to file a claim for the property within the allotted time and in compliance with the strict requirements of Supplemental Rule G, then your property may be forfeited to the United States by default and without further notice or hearing.

Civil asset forfeiture is state-sanctioned robbery and is the great injustice of our time.

Attorney Sebastian Rucci Focuses His Law Practice on Seizures and Asset Forfeitures

Forfeiture Attorney Sebastian Rucci has 27 years of legal experience and FOCUSES HIS LAW PRACTICE ON SEIZURES AND ASSET FORFEITURES. He also works with other attorneys co-counsel on civil asset forfeiture cases.

Forfeiture attorney Sebastian Rucci will challenge federal asset forfeiture cases throughout the United States. He can file a verified claim for the seized assets, an answer challenging the allegations in the verified forfeiture complaint, seek an adversarial preliminary hearing if one was denied, and challenge the seizure by filing a motion to suppress and dismiss on multiple procedural grounds demanding the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci can show that the seized assets are not the proceeds of criminal activity and that the agency did not have probable cause to seize the funds or other assets. Even if a showing of probable cause has been made, he can file to rebut the probable cause by demonstrating that the forfeiture statute was not violated, that the agency failed to trace the funds, or showing an affirmative defense that entitles the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci is available as co-counsel, working with other counsel, where he focuses on challenging the asset forfeiture and seizure aspect of the case throughout the United States. Forfeiture attorney Sebastian Rucci often takes civil asset forfeiture cases on a contingency fee basis, which means that you pay nothing until the money or other asset is returned. Let experienced forfeiture attorney Sebastian Rucci put his experience with federal seizures and forfeiture actions to work for you, call attorney Sebastian Rucci at 330-720-0398.